Got a head full of ideas? Good. We are hiring!

Who is EveryMatrix?

EveryMatrix delivers iGaming software, solutions, content, and services for casino, sports betting, payments, and affiliate management to global Tier 1 operators and newer brands. The platform is highly modular, scalable, and compliant, allowing operators to choose the optimal EveryMatrix solution and combine it with third-party and in-house technology and capabilities.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets. The company has 1000 employees across 13 countries and serves 300+ customers worldwide, including the regulated U.S. market.

EveryMatrix is a member of the World Lottery Association (WLA) and the European Lotteries Association. In September 2023 it became the first iGaming supplier to receive WLA Safer Gambling Certification.

EveryMatrix is proud of its commitment to safer gambling and player protection while producing market-leading gaming solutions.

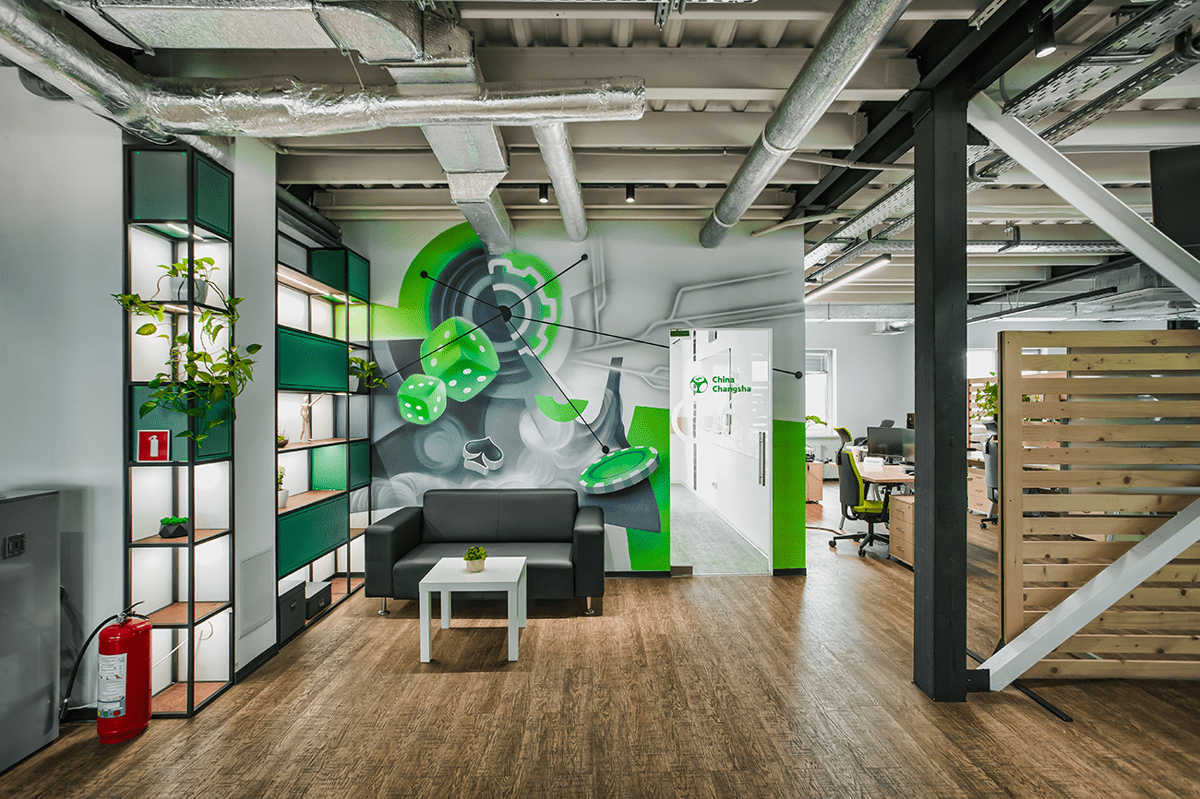

Workplace & Culture

We started small with big ideas. We managed to fill the shoes and the roles, growing in both size and – we like to think – wisdom. We've spread our reach in ten countries over three continents, taking the meaning of global as literally as possible. We invested a lot into building a friendly and professional environment that promotes personal and professional growth.

Do you want to work with us?

We always seek fun and talented people to join the crazy awesome EveryMatrix team. Join our company now and let your career grow here with us!

-

Senior System Administrator

PlayMatrix · Lviv, Kyiv · Fully Remote

-

Partnership Manager

Games · Lviv, Kyiv

-

Junior Java Developer

DataMatrix · Lviv · Hybrid Remote

-

Junior Database Administrator

GamMatrix · Multiple locations · Hybrid Remote

-

CRM Manager

Commercial · Multiple locations

-

Trainee QA Engineer

CasinoEngine · Lviv · Hybrid Remote

-

Integration Manager

MoneyMatrix · Lviv · Hybrid Remote

-

Junior Configuration Specialist

MoneyMatrix · Lviv · Hybrid Remote

-

Technical Product Manager

Technology · Bucharest · Hybrid Remote

Founded

Coworkers

Countries

Everything is possible.

Already working at EveryMatrix?

Let’s recruit together and find your next colleague.